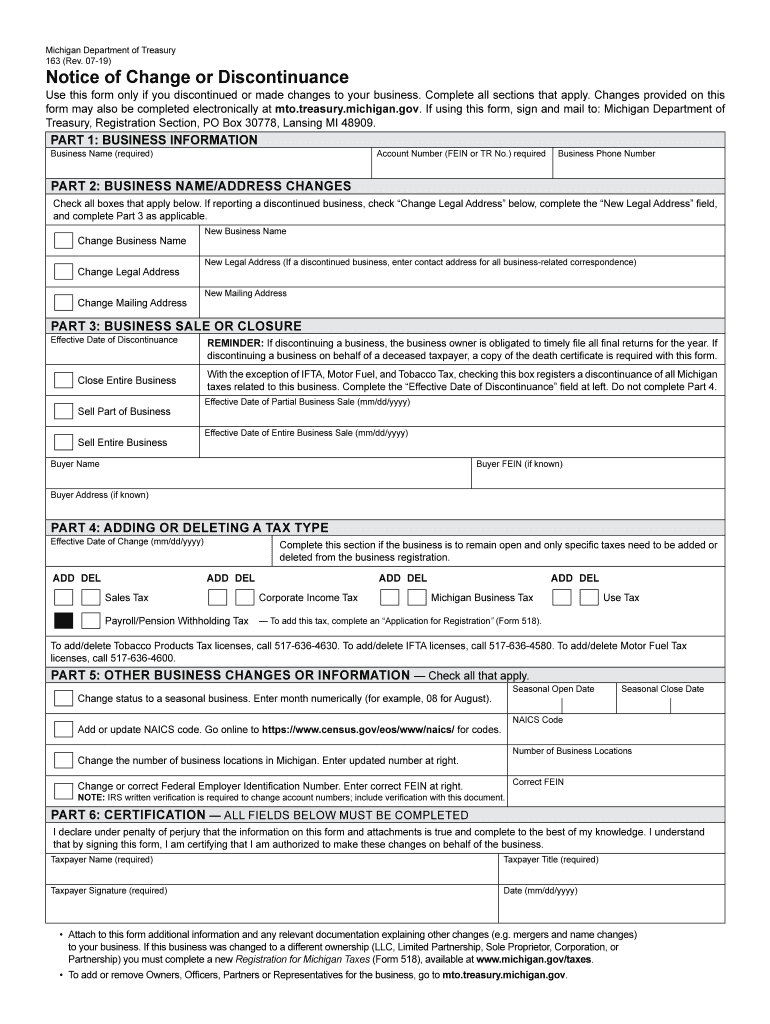

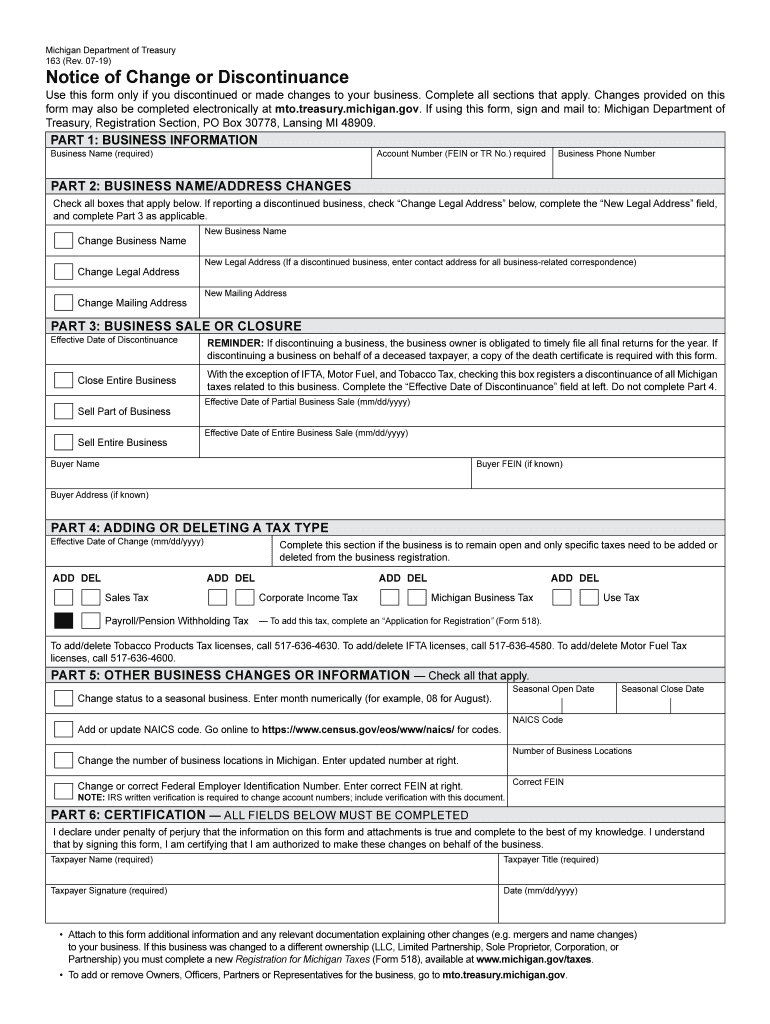

MI DoT 163 2019-2024 free printable template

Get, Create, Make and Sign

Editing state of michigan form 163 online

MI DoT 163 Form Versions

How to fill out state of michigan form

How to fill out Michigan Form 163:

Who needs Michigan Form 163:

Video instructions and help with filling out and completing state of michigan form 163

Instructions and Help about michigan form 163 instructions

In a recent study we show that when the 2-meter-long human genome folds inside the microscopic nucleus of a cell it forms 10000 loops each of these loops connects two anchor points which are far apart along the chromosome but which loop back coming close together as the genome folds in our new study we find that loops formed by a process called extrusion lets take a look at how this operates on a segment of DNA first an extrusion complex containing two subunits attaches to DNA forming a small loop in the process next the two subunits slide along DNA in opposite directions making the loop grow bigger and bigger the extrusion complex looks for a specific motif a DNA word which causes a protein called CTC to bind to the DNA if a subunit encounters the CDC motif that is pointing at it the subunit tends to stop if the CDC motif is pointing the other direction the motif won't be recognized to the subunit the motif looks as though it is backwards this behavior leads to a result we call the convergent rule the pair of CTC motifs at the ends of a loop must be pointing towards one another on the DNA our simulations also showed that when loops formed by extrusion they lead naturally to the formation of what we call loop domains this means that if two pieces of the genome are inside the same loop they tend to bump into each other more often in this physical simulation you can see how the extrusion of two loops leads to the formation of two spatially segregated domains you like the convergent rule the association between loops and domains was observed in our earlier study but at the time we did not understand why this was the case both findings and many others that you can read about in our paper can be explained by the extrusion mechanism the extrusion is an exciting model for several reasons first loops that are formed by extrusion will be knotted so if you need access to the genetic information they contain it's no problem you can just stretch them out second extrusion doesn't just lead to segregation of domains within chromosomes a collection of chromosomes that are all jumbled up will naturally become segregated if extrusion takes place the fact that chromosomes are segregated in this way inside the nucleus forming chromosome territories is well-known similarly when several chromosomes are close together loop formation by extrusion won't lead to entanglements in contrast loops forming by diffusion would routinely lead to entanglements this is important because when cells divide their chromosomes must come apart at scales much larger than a double helix the structure of the human genome is poorly understood loop extrusion provides us with a richer understanding of the genomes three-dimensional architecture you

Fill michigan business complete search : Try Risk Free

People Also Ask about state of michigan form 163

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your state of michigan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.