MI DoT 163 2019-2026 free printable template

Show details

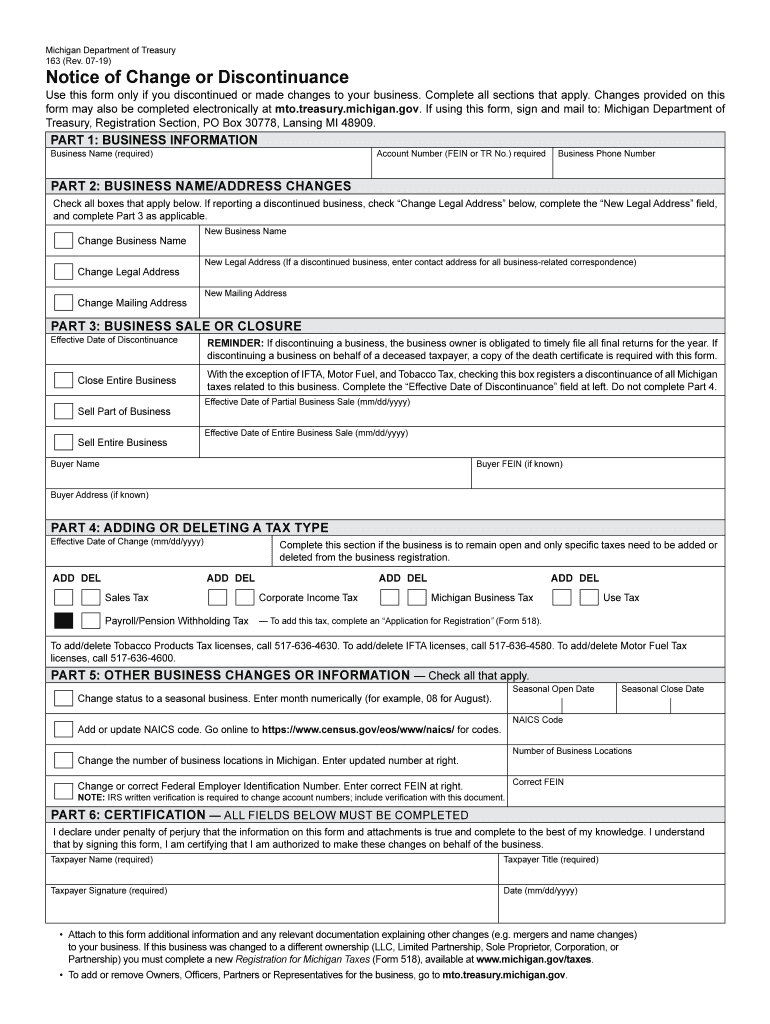

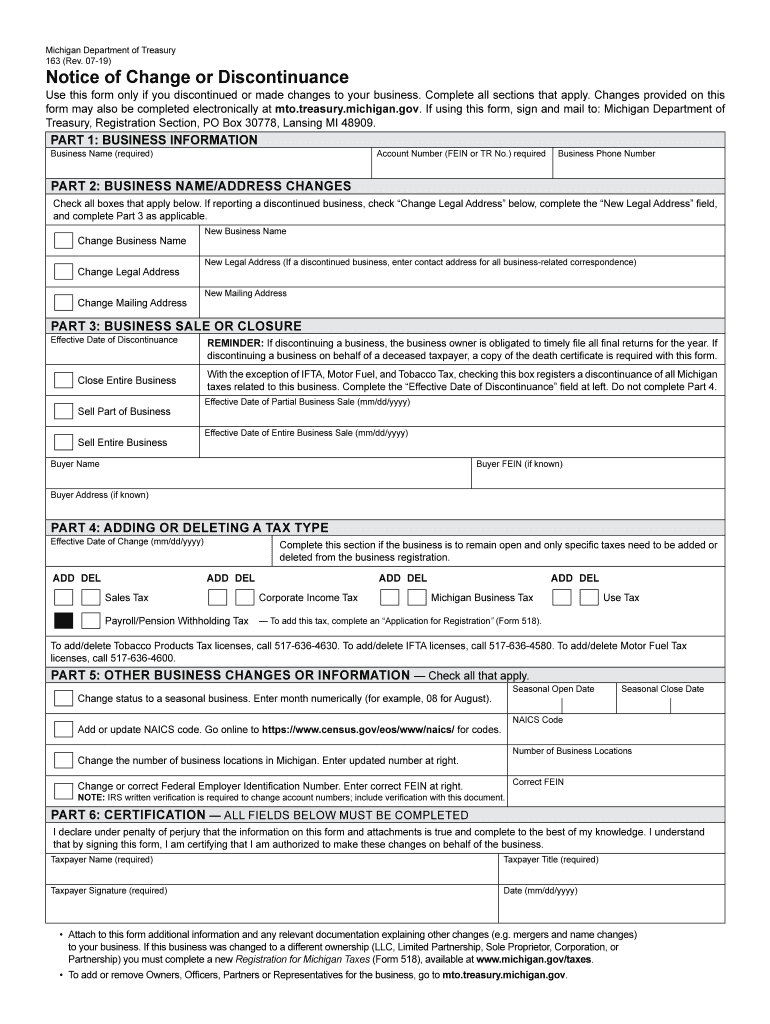

Reset Form Michigan Department of Treasury 163 Rev. 10-17 Account Number FEIN or TR Number Notice of Change or Discontinuance Use this form only if you discontinued or made changes to your business. ADD DEL PART 3 CHANGE TAX TYPE Effective Date Sales Tax Corporate Income Tax Payroll/Pension Withholding Tax IFTA Licenses Use Tax Michigan Business Tax Motor Fuel Tax License Tobacco Products Tax License To add Payroll/Pension Withholding Tax complete an Application for Registration form 518....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign closing a business in michigan form

Edit your mto treasury michigan gov form 163 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 163 michigan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 163 notice of change or discontinuance online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 163 state of michigan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 163 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out michigan tax form 163

How to fill out MI DoT 163

01

Obtain the MI DoT 163 form from the Michigan Department of Transportation website or your local office.

02

Read the instructions provided with the form carefully.

03

Fill in the personal information section, including your name, address, and contact details.

04

Indicate the purpose of the form by checking the appropriate boxes.

05

Provide any required vehicle information such as VIN, make, and model.

06

Sign and date the form at the designated area.

07

Submit the completed form to the relevant department or office, either in person or by mail.

Who needs MI DoT 163?

01

Individuals applying for certain permits or licenses related to vehicle operations in Michigan.

02

Businesses requiring official documentation for vehicle registrations or permits.

03

Anyone seeking to report or request information regarding vehicle status with Michigan's Department of Transportation.

Fill

mi 163 form

: Try Risk Free

People Also Ask about michigan sales tax form 163 blank

Who must file Michigan business tax return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who is required to file Michigan business tax return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Does Michigan require nonresident withholding?

Who Is Subject to Withholding? Nonresident members of flow-through entities are subject to withholding of individual income tax. MCL 206.12 defines members of a flow-through entity as a shareholder of an S corporation, a partner of a partnership, or a member of a limited liability company.

How do I close my Michigan sales and use tax account?

A request to cancel your account must be made, in writing, within 15 days from the date of discontinuance. Form 4460, IFTA Request for Cancellation of Account is available on our website.

Do I need to file a Michigan corporate tax return?

Corporations with less than $350,000 of apportioned gross receipts or less than $100 in liability are not required to file or pay the CIT. Flow-through entities pay no CIT, and income passes through to the owners' personal income tax (PIT) return. Michigan's current personal income tax rate is 4.25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 163 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit michigan department of treasury form 163 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit state of michigan form 163 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing mi form 163, you need to install and log in to the app.

Can I edit form 163 michigan department of treasury on an Android device?

You can make any changes to PDF files, such as michigan gov form 163, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is MI DoT 163?

MI DoT 163 is a reporting form used in the state of Michigan for the Department of Transportation (MDOT) to track and manage certain transportation-related activities and data.

Who is required to file MI DoT 163?

Individuals and organizations involved in specific transportation projects or activities that fall under MDOT's regulatory purview are required to file MI DoT 163.

How to fill out MI DoT 163?

To fill out MI DoT 163, one must provide the necessary details about the transportation project or activity, including project identification, description, and required data fields as specified in the instructions provided by MDOT.

What is the purpose of MI DoT 163?

The purpose of MI DoT 163 is to facilitate the collection and management of data related to transportation projects, ensuring compliance with state regulations and enhancing planning and funding processes.

What information must be reported on MI DoT 163?

MI DoT 163 requires reporting information such as project title, project location, project cost, funding sources, and any pertinent timelines or milestones related to the transportation activity.

Fill out your MI DoT 163 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Sales Tax Form 163 is not the form you're looking for?Search for another form here.

Keywords relevant to michigan lara form 163 michigan

Related to michigan form 163 notice of discontinuance

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.